What is an Employee Benefits Program and How Do You Create One?

Table of contents

- What is an employee benefits program?

- Different types of employee benefits

- How to design an employee benefits program

- Common mistakes to avoid while designing an employee benefits program

- How do you measure the success of employee benefits packages?

- How should you manage your employee benefits program?

- FAQs

- Conclusion

Employee benefits are an essential component of the compensation package. They show your team that you care about their well-being and give you an edge when recruiting talent.

An employee benefits program includes health plans, medical insurance, and paid time off. Beyond these basic elements, you can consider how additional benefits can help your employees.

This guide covers everything you need to know about creating a benefits program that supports both employees and their families.

What is an employee benefits program?

An employee benefits program includes types of compensation and perks that employees receive alongside their base salary or wage.. These benefits, financial and non-financial, provide direct or indirect employee security. The importance of employee benefits programs is that they act as incentives or valuable bonuses for both potential hires and current employees.

Some countries legally mandate certain benefits, such as healthcare, while others leave it up to the discretion of the employer. It's important to ensure that your benefits package adheres to all state and federal regulations.

Why is having an employee benefits program necessary?

Let's dive into the importance of offering employee benefits through your company.

Implementing a strong employee benefits program has several advantages for an organization. To start, it motivates your current workforce and attracts potential employees.

Other benefits of a successful employee benefits program are as follows:

Increased productivity

Benefits programs make employees feel valued and improve wellness in the workplace, boosting morale, productivity, and quality of life. By easing employees' financial burdens and reassuring them that they're supported, they can come to work with clearer minds are focus more deeply on their work.

Increased retention and loyalty

According to the Society for Human Resource Management (SHRM), employees satisfied with their benefits program are 71% more likely to stay in their jobs, reducing turnover costs.

Want to learn more about inspiring loyalty and retaining top talent? Read this guide for compensation and benefits professionals.

Improved recruiting

A superior benefits program compared to that of your competitor makes it attractive to top talent. Unique benefits offerings may include things like unlimited PTO, tuition reimbursements, fitness reimbursements and wellness programs, or even free lunch programs for in-office employees.

Lower absenteeism

Better benefits can enhance employee engagement, leading to improved attendance and significantly lower absenteeism.

Improves overall employee well-being

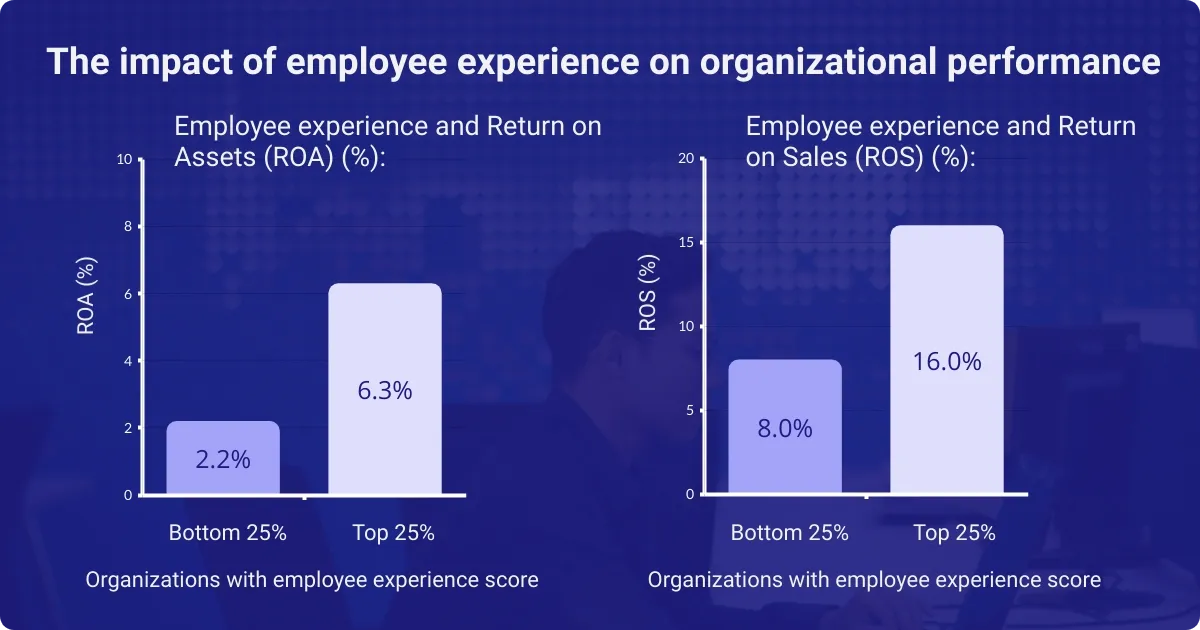

Workhuman® research shows that the top 25% of organizations in terms of employee experience get a 3x return on assets and a 2x return on sales than those in the bottom quartile.

Positive employee experience

The employee experience index depends on five dimensions - belonging, purpose, achievement, happiness, and vigor. Offering a quality benefits package can greatly improve your employees' experience of work.A positive employee experience directly benefits Return on Assets (ROA) and Return on Sales (ROS).

Different types of employee benefits

The employee benefits an employer offers depend on factors such as company size, location, and industry standards.

You can offer monetary benefits, such as bonuses and stock options. There are also non-monetary benefits, such as in-office child care centers or snack stations. There are long-term benefits, such as 401ks or other retirement benefits, and short-term benefits, like commuter reimbursements.

Benefits required by law are called statutory benefits, such as FMLA leave, and those at the employer's discretion are called non-statutory, such as company off-site opportunities.

Federally required employee benefits

The federal government in the US defines legal or statutory benefits that every employer must provide to its employees. These include:

Social security and medicare contributions

Social Security taxes in the US form the retirement fund, and Medicare is the public health insurance for citizens above 65. They also assist people who cannot work due to disability.

Social Security also provides survivor benefits for dependents of an individual who has passed away. Employers and employees pay 6.2% each, while the self-employed pay 12.4% of their earnings up to a taxable maximum.

Unemployment insurance

The Federal Unemployment Tax Act (FUTA) supports individuals who have lost a job but are willing and able to work. It is 6% of the first $7,000 of the employee's earnings payable only by the employer.

A similar unemployment insurance program, SUTA, exists at the state level, but its tax and contribution rates vary.

Overtime pay

The Fair Labor Standards Act (FLSA) mandates overtime pay for hours above 40 in a week. It must be at least 1.5 times the usual wage the employee receives. However, the FLSA does not mandate overtime payment for Saturdays and Sundays, holidays, weekends, and nights.

Family and Medical Leave Act (FMLA) protections

FMLA guarantees eligible employees up to 12 weeks of unpaid annual leave with job protection. Employees may choose to take this leave to care for a newborn or a family member or to adopt a child.

An employee becomes eligible for FMLA if they have worked for at least 1,250 hours over the past 12 months and if the employer has 50+ employees within a 75-mile radius.

Health insurance (Affordable Care Act)

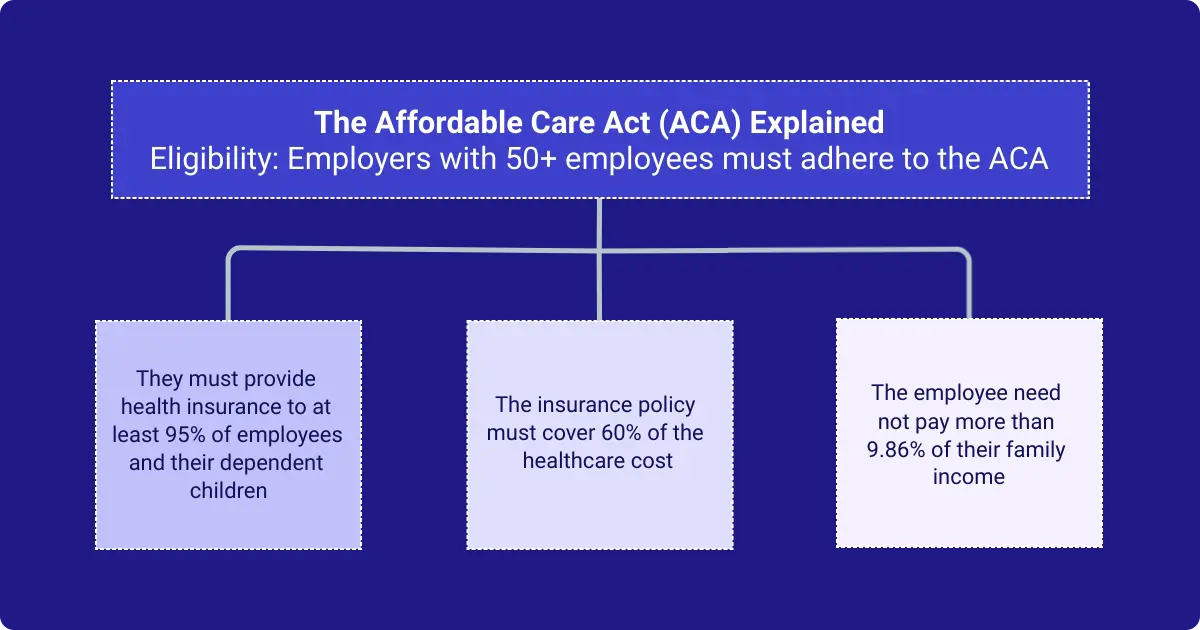

The Affordable Care Act (ACA) mandates eligible employers to provide health insurance. To be eligible, the organization must have 50+ employees.

They must provide health insurance to at least 95% of employees and their dependent children. The insurance policy must cover 60% of the healthcare cost, and the employee need not pay more than 9.86% of their family income.

Disability insurance

Disability insurance provides an alternative source of income if an employee cannot work due to illness or injury. This insurance helps families pay bills and cover living expenses during the employee's downtime. The insurance may be mandatory if there are higher chances of workplace injury.

Most sought-after employee benefits

These employee benefits may or may not have a direct financial impact on the earnings, but still are most sought after for overall well-being and workplace satisfaction:

Remote work

Although it has always existed, remote work gained popularity after COVID-19. According to a survey, 37% of employees say that working from home is important for them, even for an in-office role. Tools such as Slack and Zoom have made this possible for an even greater number of employees.

Flexible scheduling

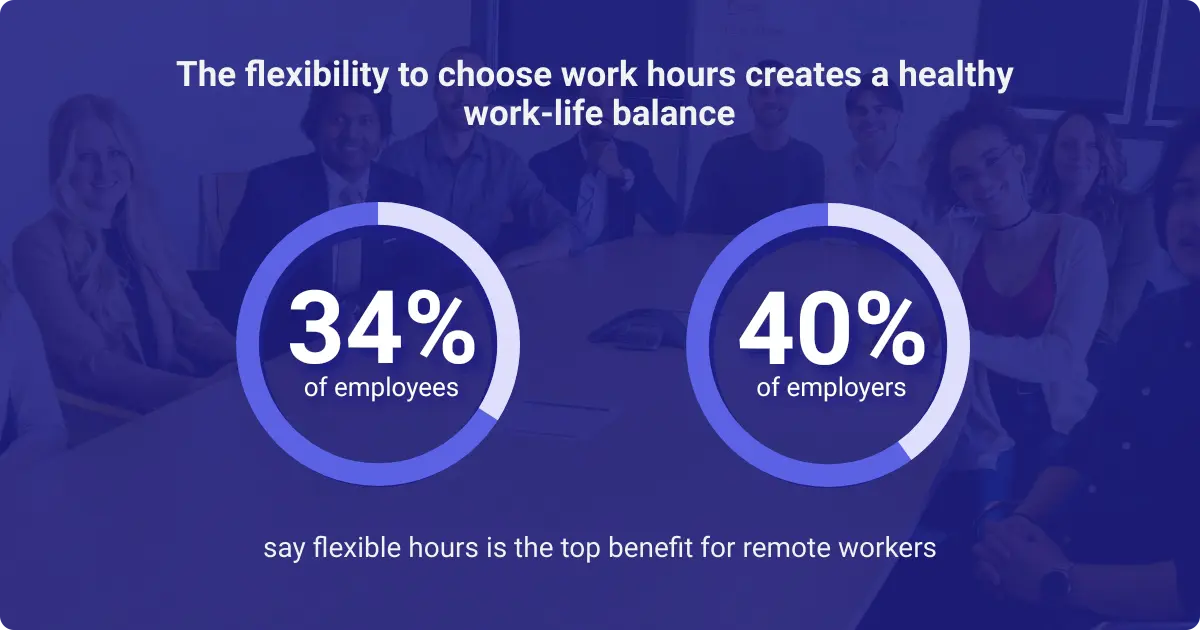

Flexibility to choose work hours creates a healthy work-life balance for both employees and employers. 34% of employees and 40% of employers name flexible hours as the top benefit for remote workers.

Comfort and wellness benefits

Wellness benefits have become an integral part of new benefits packages in US workplaces. These corporate employee wellness programs can include everything from mental health resources to sabbatical leaves.

See also: Paid Maternity Leave: An Overlooked Human Right

Some of the most sought-after employee benefits examples include gym memberships or discounts, company retreats, and in-house coffee bars and eateries. Having in-house gymnasiums and meditation rooms are alternatives to external memberships.

Integrating holistic wellness benefits, such as yoga and meditation, can also help reduce stress and burnout, promoting health and wellness, and creating a more balanced work environment. These perks can all help foster a sense of wellbeing in employees.

👋 Attention leaders! Do you want to improve employee wellbeing and drive business success? Discover how strategic recognition can help in the Workhuman and Gallup report: “Amplifying Wellbeing at Work and Beyond Through the Power of Recognition.”

🔍 Learn how recognition can improve engagement, reduce burnout, and increase company loyalty, resulting in clear ROI. 💰

🌎 The report examines a large-scale study of over 12,000 employees across 12 countries and uncovers the connection between recognition and wellbeing in each region.

🚀 Take action to improve employee wellbeing today!

Relocation assistance

When employees relocate for work, both parties must negotiate the terms of relocation assistance at the time of the interview.

Common relocation benefits include packing service, home-selling assistance, transportation service for house goods, paid-for house search, temporary housing, and travel reimbursement for a fixed number of days after relocation.

Commuting or travel assistance

Transportation benefits offset the cost of traveling to and from work. They can include reimbursable cash benefits, monthly public transit passes, parking and gas expenses for cars, or expenses for commuter highway vehicles.

Employee education and development programs

Continuous upskilling through in-house or external training programs helps employees grow in their careers. Companies can sponsor external training that aligns with common business objectives, such as Six Sigma or artificial intelligence (AI) prompting.

The training depends on the nature of business and employee-employer goals.

Mentorship opportunities

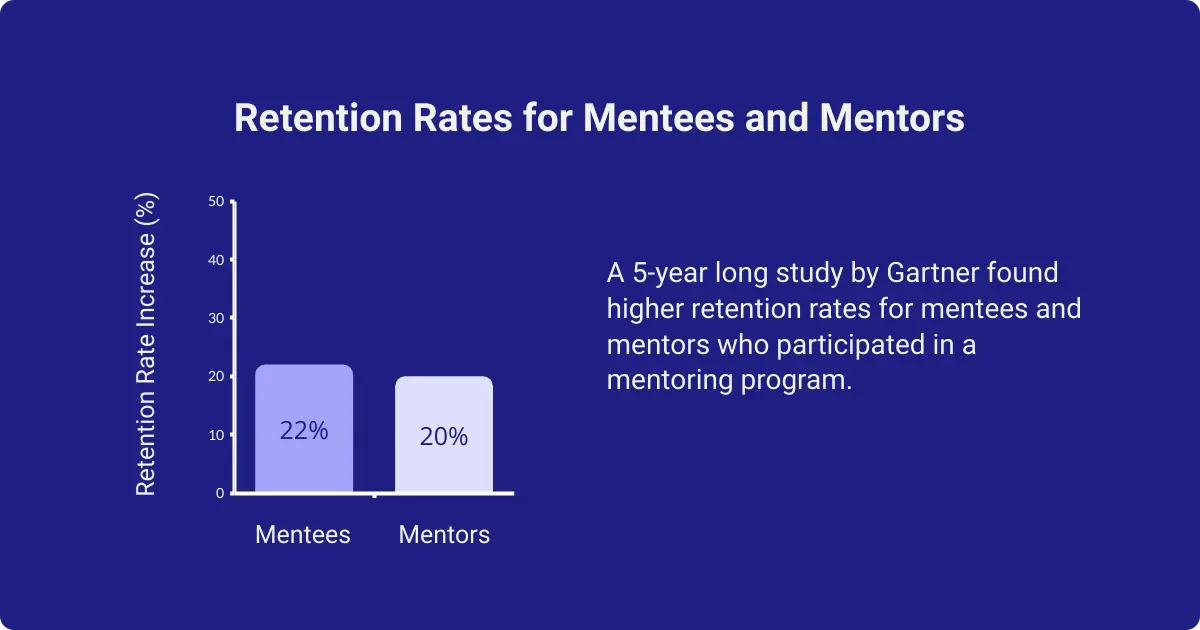

A five-year study by Gartner found retention rates of 22% and 20% for mentees and mentors who participated in a mentoring program, respectively.

Mentorship programs that align with organizational goals benefit employees and improve the outcomes of diversity, equity, inclusion, and belonging (DEIB) initiatives.

Stock options and equity sharing

Small but fast-growing companies often offer equity-sharing opportunities to attract high-quality talent. Listed businesses offer stock options during the IPO to their high-value employees to increase retention and promote ownership within employees.

As the company grows, the wealth of the employee grows, which inspires them to give their best effort.

Retirement plans

Retirement plans help individuals save money for their retirement.

A common form of retirement savings is the 401(k) program. This employer-sponsored plan allows employees to contribute a portion of their salary for retirement before taxes are deducted. The money grows tax-deferred until you withdraw it upon retirement.

Life insurance

Life insurance provides financial compensation in the event of an employee’s passing. Unlike health insurance, it is not common for employers to offer life insurance policies, especially in manual labor fields where there is a higher risk of occupational hazards.

How to design an employee benefits program

In this section, we will guide you through a simple tutorial to design an effective employee benefits program.

Step 1: Identify the organization's objectives

Having clear goals will guide your benefits selection process and help you determine the budget. These objectives should reflect the needs of both the organization and the employees.

For example, if you work in niche technology, you may want to retain and upskill your existing talent through training and development, which can be one of the benefits.

While drafting the objectives, know your short-term, medium-term, and long-term goals, financial targets, availability of talent in the market, and cost of employee churn.

Things to consider while designing your employee benefits program:

- The industry, mandatory benefits, and company size

- Whether to hire a benefits broker to manage the process

- Employee benefits preferences and needs

- Employee retirement options, gratuity, pensions, and well-being initiatives

- Regularly evaluating and revising goals to stay relevant and objective-oriented

- The rising costs of the benefits you offer

Step 2: Determine the budget

While there are a range of statutory and non-statutory employee benefits, you must know your budget. It is mandatory to offer the statutory benefits, but you can find a middle-ground with the non-statutory ones.

For example, you must provide health insurance that covers 60% of the healthcare cost, but you can choose travel reimbursement according to your budget.

Step 3: Conduct a needs assessment

Your benefits program must begin with gathering and understanding employee needs. You can use simple feedback methods like surveys, interviews, and focus groups.

Additionally, leverage market research to review current benefits plans and analyze workforce demographics.

Step 4: Formulate a benefits plan

After gathering the necessary information, you can begin designing your employee benefits plan. The success of this step depends on how thorough and detailed the information gathering was.

Sort the benefits by priority and track the benefit-cost ratio (BCR).

Step 5: Communicate the benefits plan to employees

Develop a solid communication strategy to help employees understand their benefits and provide initial feedback on the program.

Create awareness of the new program and, if needed, adjust it based on employee reception.

You can communicate the benefits plan through these strategies:

- Educate employees during onboarding

- Empower managers to share the benefits during 1:1 meetings

- Create the conversation as a part of the culture

- Make the information easily accessible through intranet or portals

- Create a continuous feedback loop

Step 6: Develop a periodic evaluation process to determine the effectiveness of benefits

Consistently gauging the effectiveness of your investment is as important as implementing it. Establish a scheduled process or feedback mechanism for evaluating and assessing the effectiveness of your benefits program.

For this purpose, you must track various KPIs, indicators, and aspects, which we will cover in the next section.

Common mistakes to avoid while designing an employee benefits program

These common mistakes can leave employees dissatisfied and confused:

Lack of alignment

One of the biggest mistakes is setting up employee benefits without aligning them with the organization's goals, vision, culture, and values.

For example, if your core values are innovation and collaboration, you must promote creativity, teamwork, learning, flexible work schedules, and recognition programs.

Lack of customization

There is no one-size-fits-all benefits package. Every package is unique and diverse and demonstrates the organization's characteristics. The benefits must align with the region, labor market, and market segments.

Most organizations value employee health insurance plans, but the other benefits might vary. You can also give employees the flexibility to customize their own benefits package.

Lack of communication

A well-designed employee benefits program is only as good as its communication process. Your employees must know what they are eligible for to use and appreciate it.

Use clear and consistent messaging across multiple channels to inform employees about the benefits, options, eligibility, enrollment, and usage.

Lack of benchmarking

The next common mistake is to design a benefits program without comparing and benchmarking it against your competitors and industry standards.

Benchmarking helps you assess the strengths and weaknesses within the program and adjust when required.

Lack of evaluation

An employer's benefits must undergo regular evaluation to assess the return on investment (ROI) and value on investment (VOI). Use quantitative and qualitative metrics to determine cost utilization, outcomes, and satisfaction scores.

You can also evaluate how the benefits are influencing talent acquisition, and optimize accordingly.

How do you measure the success of employee benefits packages?

Measuring the outcomes of your programs to amend and adjust them for maximum effectiveness is essential. Without this information, developing a sustainable strategy for your benefits program can be challenging.

Define your desired outcomes

First, focus on the program's desired outcomes rather than solely tracking your return on investment (ROI). Employee benefits are investments, but they do not always directly impact your finances.

For example, if your benefits program aims to attract new talent or retain current employees, tracking financials alone might give you a false impression that the program is not working.

Identify the necessary KPIs

To track and enhance your team's performance and engagement, focus on key performance indicators (KPIs) that directly reflect your desired outcomes.

Here are some KPIs to monitor when measuring the success of your employee benefits packages:

- Employee capacity: realistic employee performance versus the maximum performance you can achieve with given resources.

- Absenteeism rate: the average number of days of absence as a percentage of the total number of working days over a period.

- Employee turnover: the frequency of employees leaving an organization over a period of time.

- Employee retention: a combination of several metrics, such as employee satisfaction score, retention rate, turnover rate, absence rate, and turnover cost.

- Benefits utilization rate: the output of dividing the number of employees who utilize the benefits by the total number of eligible employees.

- Cost-benefit analysis: the ratio of the cost of creating and maintaining a benefits program and the returns or benefits from doing so.

Leverage employee satisfaction surveys

Employee satisfaction surveys offer valuable insights into how employees feel about their benefits package and overall job satisfaction.

Surveys can also enhance workplace engagement by making employees feel valued and fostering trust and transparency. Different types of surveys include:

- Pulse surveys through anonymous forms

- Feedback through 1:1 meetings with managers

- Surveys during annual review meetings

- Open house questions in a group setting or team meeting

How should you manage your employee benefits program?

Now, you know how to run mental, physical, and financial wellness programs for employees. Here are some essential tips for managing these programs and keeping them relevant and effective:

- Identify what employees care about and choose benefits that meet those needs

- Simplify the program to avoid overwhelming employees with too many details

- Be open to changes based on employee feedback

- Use data and results to inform future decisions and make program adjustments

- Incorporate data from your employee experience management program

Here are four ways forward-thinking leaders are modernizing their compensation and benefits and total rewards strategies to meet the never-before-seen challenges of today’s world.

Learn more

FAQs

How much should I spend on employee benefits?

This depends on factors like the employer's industry, company size, and financial situation. A good guideline is to keep benefits costs between 125% and 150% of the employee’s salary.

Do employee benefits programs affect taxes?

Benefits programs are similar to other forms of employee compensation. According to the IRS, depending on the specific benefits, some employee benefits may be tax deductible. For example, health insurance can be tax-deductible for employers, while taxable fringe benefits are not.

Conclusion

When creating an employee benefits program, consider the needs of both the employees and the company. Implement a variety of rewards to keep your team engaged and make them feel appreciated.

A well-designed employee benefits program can help attract and retain top talent in your organization. It can improve employee morale and productivity, reduce turnover, and boost the company's bottom line.

About the author

Ryan Stoltz

Ryan is a search marketing manager and content strategist at Workhuman where he writes on the next evolution of the workplace. Outside of the workplace, he's a diehard 49ers fan, comedy junkie, and has trouble avoiding sweets on a nightly basis.