What is the Employee Retention Credit (ERC)? 2025 Complete Guide

The Employee Retention Credit was a beacon of light for failing businesses during the COVID-19 pandemic. Introduced in March 2020, it was developed to encourage employers to keep their workers during the pandemic despite the business closure.

Though it has since expired, employers can still take advantage of the ERC in 2022 to improve their company retention rate.

In this article, we'll delve into the ins and outs of Employee Retention Credit and employee retention.

What is the Employee Retention Credit?

Employee Retention Credit (ERC) is a refundable quarterly tax credit that was developed in response to the economic shutdown and COVD-19 pandemic to encourage businesses to keep employees on their payroll. This credit is 50% to 70% of the employee’s pay depending on the year submitted, and is up to $10,000 per quarter.

Understanding the ERC: Employee Retention Credit FAQ

Here's everything you need to know about Employee Retention Credit, including how to claim ERC for your business:

Which employees count toward eligibility?

The Employee Retention Tax credit is available to all business employees regardless of company size or type, including tax-exempt organizations.

The only organizations that aren't qualified for the Employee Retention Tax credit are employees of small businesses who take small business loans, as well as state and local governments (along with their instrumentalities).

Who qualifies for the employee retention tax credit?

- Business is fully or at least partially suspended by the government due to the COVID-19 pandemic

- Experienced significant decline in gross receipts in comparable quarters with at least 50% decline.

What's the difference between PPP and ERC?

The PPP (Payroll Protection Program) provides small businesses with eight weeks of payroll assistance, including benefits.

It's established by the CARES Act and implemented with support from the Department of the Treasury. If the employer complies with the terms (i.e., spending funds on business rent or payroll), the loan doesn't need to be repaid.

The ERC, on the other hand, is a tax credit. It's payable via check from the IRS and doesn't need to be repaid.

Can you get ERC and PPP?

According to the IRSOpens in a new tab, it's possible for employees to claim both ERC and PPP as stated under section 206(c) of the Taxpayer Certainty and Disaster Tax Relief Act of 2020. Eligible employers can claim ERC and PPP if:

- The PPP loan is separate from the employer's qualifying wages

- The employer obtains qualifying wages with proceeds from a forgiven PPP loan, as long as it isn't as the ERC qualifying wages

- One member receives PPP, while the other claims ERC.

How do I calculate the employee retention credit?

To calculate the Employee Retention Credit, you must first determine when your business was affected. The Employee Retention Credit is 50% and 70% of qualified employee wages paid in a calendar quarter in 2020 and 2021 respectively.

For 2020, the credit applies to wages paid before January 1, 2021, and after March 12, 2020. Eligible wages max out at $10,000, so the maximum eligible wages paid during this period per year is $5,000. For 2021, the maximum credit for eligible wages is $28,000.

How do you claim the credit?

To claim the Employee Retention Credit, eligible employers must report their qualified wages, as well as any related health insurance costs, for every quarter on their quarterly employment tax returns using an amended Form 941X.

The IRS gives employers up to three years (from the date the original return was filed) to file an amended federal employment tax return.

How to Apply for the Employee Retention Credit in 2022

Though the ERC program ended on October 1, 2021, employers still have time to apply if their business is eligible. Employers can claim this credit by simply filling out Form 941-XOpens in a new tab when filing for their federal tax returns. In the form, employers must answer the relevant questions in all three pages and sign the form on Page 5.

Employers that have yet to file for the credit may file for a retroactive ERC refund. To apply, employers must submit one of two 941-X forms: Adjusted Employer’s Quarterly Federal Tax Return Form or Claim for Refund Form.

The form looks much the same, but employers must explain the reason for the delay. They must also use a separate Form 941-X for each business quarter that needs correction or adjustment.

Is the ERTC going to expire?

The ERTC program has already expired. The exact expiration date is unclear, but it's somewhere between September 30, 2021, and December 31, 2021. For recovery startup businesses, the Infrastructure Bill ended the ERTC on January 1, 2022.

That said, eligible employers can still take advantage of the ERTC against qualified wages and applicable employment taxes. The credit can be claimed on amended payroll tax returns as long as the statute of limitations remains open, which is around three years from the date of filing.

Still struggling to hire and retain employees after the pandemic?

The COVID-19 pandemic has left a mammoth of irreversible effects on the world's economic sectors, especially small businesses. It has become more and more difficult for employers to hire (and subsequently retain) qualifying employees, as the pandemic has completely changed where and how people work.

A year into what's now dubbed The Great Resignation, job openings remain elevated at a record-breaking 11.3 million unfilled positions as of May 2022, compared to the 9.6 million the year prior.

Even so, the unemployment rate has barely changed. Despite the increased job openings, it still stands at a firm 3.6%.

Why, you ask? The answer is simple: businesses have yet to adapt to the new reality the pandemic has brought to the business world. Employers still rely on "traditional" methods of hiring, with traditional benefits and work hours.

The pandemic has changed the way people see and treat the labor market. Employers need to see that change, too.

The truth of the reality is that people have now become accustomed to working from home, working whenever they want and wherever they want. Those who have experienced these working conditions find it hard to return to the standard nineto-five. Employees have become more aware of other opportunities, and thus more likely to resign to try and improve their situations.

According to former Global 50 executive Amii Barnard-BahnOpens in a new tab, recruiters find the need to hire 5-10 times the pool of candidates because of high turnover. Even so, they still seem to find it difficult to retain employees.

Before, companies choose candidates. Now, it's the complete opposite: candidates choose the companies they want to work at. More than ever, employers have to sell themselves rather than the other way around.

Why do companies struggle to retain employees?

Though COVID-19 has had a massive impact on the job market, it's not the sole reason companies struggle to retain employees. Oftentimes, it's caused by company policies and cultures.

Here are some of the reasons companies struggle with employee retention:

Unorganized or Problematic Management

One of the biggest causes of employee turnover is unorganized or problematic management. Even if a company doesn't pay as well as its competition, employees will stay for great management. As the saying goes, "Employees don’t leave companies — they leave bosses."

Leaders that operate like dictators refuse to take others' opinions into consideration, steal credit for employees' work, play favorites, and overall lack competence, scares off good employees. The same is said of companies with poor management systems, such as the lack of feedback tools or performance reviews.

If employees feel that they're being taken advantage of, disrespected, or underappreciated for their work, it's only natural they wouldn't want to continue working for their managers.

Salary Issues

Inflation is a continuous trend that doesn't seem to have an end. Housing costs, childcare expenses, taxes, and healthcare is now at an all-time high.

According to the Bureau of Labor StatisticsOpens in a new tab, the annual inflation rate in June 2022 is the highest it's been since 1981 at 9.1%.

Other metrics have also shown significant increases over the past year, making it more and more difficult for low-wage employees to make ends meet with their current positions. Despite this, many companies refuse to update their wage schedules.

And that's not even the worst of it; companies that have been hit by the Great Resignation often pay new hires more than their old hires, leading to long-term employees quitting out of sheer indignation.

If new hires are getting paid more than them, it'd make more sense to quit and rejoin at a later date or search for a new company entirely—one that appreciates and rewards loyalty.

Diversity Issues

Even if a company pays well, employees won't stand for unequal and unfair treatment. It takes more than a written equity, inclusion, and diversity policy to convince employees to stay; they want to see these policies taking place in the workplace.

It's important to note that diversity issues don't just impact those that are directly affected by them. It also impacts team members that are deeply empathetic with those affected and value multiple cultures and perspectives.

These are the most common challenges of diversity in the workplace that a company must address to avoid high turnover:

- Salary inequality between men and women

- Disability discrimination

- Conflicting beliefs due to cultural, political, or religious standpoints

- Age and generational differences

- Acceptance of alternative lifestyle

- Prejudice, racism, and harassment among employees

Strict and Unchanging Policies

Company policies are set in place to establish consistency throughout the organization, reduce performance risk, and outline the responsibilities of both employees and employers. Without them, chaos may ensue.

However, enforcing these policies indiscriminately and strictly may cause more harm than good.

Companies should find the right balance between tough love and flexibility if they want to keep their employees productive and happy. People have always craved autonomy, but this feeling has further increased with the pandemic.

If companies give their policies some wiggle room, workers may start looking for employment elsewhere. No one wants to stay in a workplace that rules with an iron fist.

Burnout

Burnout--particularly job burnout--is a state of emotional or physical exhaustion often characterized by loss of personal identity, a sense of reduced accomplishment, and a lack of productivity. It isn't a medical condition, but it can greatly affect a person's ability to perform his/her work properly.

According to a survey conducted by DeloitteOpens in a new tab, 77% of employees have experienced burnout at some point in their jobs, with more than half citing multiple occurrences.

Burnout has always been an issue in the workplace, but it has greatly increased in the past several years.

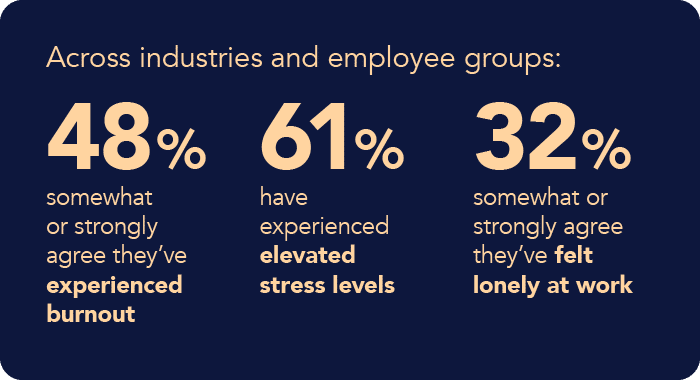

A March 2021 Workhuman survey of more than 3,000 U.S. workers found that employees across industries were burned out, stressed and lonely, with women experiencing stress and burnout more than their male colleagues.

With the current state of the world, many had to deal with new work policies and schedules, increasingly hostile customers, and changing business models.

And with the Great Resignation, employees are forced to take on more responsibility than they can manage with no additional rewards. This leads to burnout and eventual resignation if left unchecked.

Work/Career Stagnation

Work stagnation occurs when an employee feels a lack of engagement or advancement with their work or career. In most cases, it happens when employees don't see any positive changes in their career and feel like they've learned everything there is to learn in their position.

Most employees expect a clear path to professional development or advancement. Without it, employees feel bored and unmotivated in their jobs, resulting in them quitting or switching positions. As such, employers and managers should regularly meet up with their employees to discuss their future career goals and follow through with promised promotions.

What can you do to retain top talent?

Employee retention comes with a ton of benefits, including increased employee loyalty, improved customer relations, reduced hiring costs, and a positive brand reputation. Businesses with high turnover rates experience low productivity rates and employee morale, which can cost a company financially and economically.

Without the right strategies, retaining top talent can be a challenge. Here are some top tips to keep a top talent's loyalty:

Offer the Ability to Grow

As mentioned earlier, employees that aren't given clear paths to advancement are more likely to quit their jobs. As such, you should always provide top talents with professional and career development opportunities to strive forward to.

Doing so lets employees feel like they're an important part of a company's success. They'll feel valued and appreciated, plus they'll feel like their time is put into bettering their future.

According to studiesOpens in a new tab, Millennials and GenZers crave professional and career development more than most other generations. Up to 80% of them would leave a company that doesn't offer clear paths to advancement.

Encourage Input and Feedback

In other words, allow your top talents to speak their minds. Create a culture where employees can freely give input and feedback, so they'll feel heard and acknowledged.

Organizations that encourage employee input have seen increased retention rates and stronger performance, according to a report published by the Harvard Business Review.Opens in a new tab

Hold regular meetings and survey how workers feel about their workplace.

Once you've collected the surveys, don't just put them aside; take them into consideration and show your employees that you're actually listening to their feedback.

Provide Frequent Praise and Constructive Criticism

Employees that are frequently praised for their work are more likely to stay because they feel seen and appreciated. Not only that, but it also provides a boost to morale and motivation, job satisfaction, and engagement.

A recent study conducted by Gallup and Workhuman found that employees who receive the right recognition at work are often less likely to report being burned out “always” or “very often” by almost 50%.

The same is said with constructive criticism, but employers must be wary of how to present and communicate it with their top talents.

Consistent, one-on-one meetings are a great way to share constructive criticism without it feeling too rushed or not genuine. It's also then that employers can give their employers some advice, feedback, and praise.

Frequent, high-quality check-ins between managers and employees are essential. With Conversations, they're easy. Learn more.

Pay Competitive Salaries

One of the easiest and most obvious ways to retain top talent is to increase or offer better-than-average salaries and unbeatable benefits. High pay and excellent benefits are great incentives to keep top talents in the company. Employers can also provide retention bonuses to further solidify their loyalty to their workplace.

It goes without saying that well-compensated employees are more likely to stay in their jobs long-term. It benefits companies, too, as they'll spend less time and money looking for and interviewing new hires.

The recruitment process alone can cost double or even triple the amount it takes to retain an employee - and that's without training, relocation, renewals, etc.

Instead of going through the whole recruitment process, show your most loyal and top talents your appreciation by increasing their pay. For most companies, a typical pay raise falls around 5%, but they can go up to as much as 20% in certain situations, such as wanting to retain top talent.

Stick to Work-From-Home Options

The number of people working from home (WFH) has radically increased during the COVID-19 pandemic. Though offices have now opened up, some companies kept their WFH practices due to the comfort they provide to their employees.

Companies that forced employees to return to the office have experienced greater turnover. If you're planning to bring your top talents back to the office, you might face some difficulties retaining them. This is especially true now, as a lot of companies offer remote or hybrid opportunities with great pay.

The logic here is simple: increased flexibility for both work hours and work location help increase employee satisfaction, thus leading to employee retention. Working from home provides both, so stick with flexible work options as much as possible. [/blogbox]

Conclusion

Employee Retention Tax Credit (ERTC), also known as Employee Retention Credit (ERC), is a quarterly tax credit given to employers affected by the economic shutdown caused by the COVID-19 pandemic.

In 2020, wages of up to $10,000 can be counted to determine the amount of 50% credit. This figure has increased in 2021 to 70%, again with a maximum payment of $10,000.

To qualify for the ERC, an employer's business must be fully or at least partially affected by the COVID-19 pandemic and had/have experienced at least a 50% decline in gross receipts to comparable quarters.